More Like This

-

Product / Service

Energy Insurance and Risk Management

-

Product / Service

Energy Transition Insurance and Risk Management

The nuclear resurgence is underway — fueled by energy security concerns, net-zero ambitions, and unprecedented power demands from data centers and other energy-intensive infrastructure. Today, around 70 reactors are under construction globally,1 and investment in small modular reactors (SMRs) is accelerating. The industry is poised for record generation and transformative growth by 2050 — the deadline set by COP28 to triple nuclear capacity.

Product / Service

Energy Insurance and Risk Management

Product / Service

Energy Transition Insurance and Risk Management

Despite momentum, headwinds remain. Nuclear’s global energy share has dropped to 9%, marking the lowest point in 40 years.2 By contrast, solar and wind are being added at rates more than a hundred times faster than nuclear capacity.3 Fleet aging is a critical operational and financial issue amid exponential load growth: Two-thirds of reactors worldwide are now older than 31 years and 48 net reactor units have come offline since 2005.4

Careful planning, proactive risk management and strategic investment are some of the essentials to help manage the sector’s challenges:

Nuclear development is more urgent with energy security under threat. Recent geopolitical shocks, such as the spike in gas and electricity prices after Russia’s invasion of Ukraine, exposed the fragility of energy systems reliant on limited sources. Scaling nuclear power offers a pathway to greater market stability and long-term energy resilience.

Below, we provide a blueprint to manage risk and enable progress in nuclear investments across four pillars: SMR industrialization, life extension, project delivery, and workforce retention and attraction.

Annual data center demand is expected to reach 945 terawatt hours by 2030 — a 165% increase and equivalent to Japan’s total electricity consumption today.

Source: International Energy Agency

SMRs can replace decommissioned coal stations and serve a broad spectrum of users — from isolated communities to industrial hubs — making them ideal for decarbonization and brownfield deployment. Their modular architecture enables phased deployment, aligning capital expenditure with near-term load forecasts to reduce upfront financial risk. But to realize their full potential, developers must prioritize repeatability, standardization and proactive risk management.

| Large Reactors | Large Reactors (Advanced) | Small Modular Reactors | Microreactors | |

|---|---|---|---|---|

| Timeline | Since 1950s (current fleet) | Deployed recently | In development | In development |

| Footprint (km2) | 6 | Varies | 0.2 | <0.004 |

| Electrical Capacity (MW) | 1,000+ | 400-1,400 | 20-300 | <20 |

| EPZ (km) | 16 | 0.24-16 | 0.311 | <0.311 |

| Coolant | Water | Water, gas, metal, salt | Water, gas, metal, salt | Water, gas, metal, salt |

| Control Approach | Active | Mostly passive | Mostly passive | Mostly passive |

| End Products | Electricity, heat | Electricity, heat, steam | Electricity, heat, steam | Electricity, heat, steam |

| Applications | Base load electrical power | Base load, demand response, industrial electricity, industrial processes such as hydrogen production | Base load, demand response, industrial electricity, industrial processes such as hydrogen production | Power for remote locations, mobile backup power, maritime shipping, mining, military, disaster relief, hydrogen production |

| Customers | Large utilities | Mostly large utilities with some associated industries | Utilities, municipalities, industry | Military, municipalities, industry |

| Cost Range | $5-9 billion | Mixed | $800 million-3 billion | $49-86 million |

| Scalability | Adding new reactors is difficult | Mixed | Designed to add new reactors as demand increases | Designed to add new reactors as demand increases |

Source: The Energy Transition Institute

Only a handful of SMRs are operational today — in Russia and China — while progress on new-build construction projects is gaining traction in the U.S., Canada and Argentina. Limited operational track records, alongside high capital costs, the volume of competing designs and regulatory uncertainty, continue to challenge insurability and investor confidence. To be widely deployed, small and advanced modular reactors must achieve a competitive levelized cost of electricity — estimates vary from $60/MWh to $140/MWh. Achieving this will depend on standardization and serial factory manufacturing.

Many view SMR projects as FOAK by default, but this is not always accurate. A significant number of leading SMR programs adapt proven Gen III and Gen III+ reactor designs with lower output to reduce technological and execution risk. Using established operational data and regulatory precedents helps streamline deployment and accelerate project maturity.

Even the classification of Sodium-Cooled Fast Reactors (SFRs) as FOAK belies their historical context. In the U.S., SFR technology dates back to the Experimental Breeder Reactor II (1964–1994) and the Fast Flux Test Facility (1982–1992). France, Russia and Japan have also operated SFR prototypes for decades. While the concept isn’t new, SFRs have yet to be deployed commercially at scale.

Comprehensive insurable risk breakdowns conducted in collaboration with consultants and engineering teams can help secure design insurability and accelerate deployment.

Case Study

Extending the life of existing nuclear energy assets is a relatively fast and cost-effective way to maintain clean baseload power. Refurbishments like retubing, heavy-component replacement and digital instrumentation upgrades can add 30-35 years to reactor lifespans, doubling their value and avoiding the emissions and costs of new builds.

But nuclear life extension can introduce risks. For example, the permanent closure of the Crystal River and San Onofre plants in the U.S. in 2013 was linked to structural and equipment issues.

Updated safety guidance, regulatory reforms and financial incentives are part of a recent push to support long-term operation (LTO) of nuclear power plants in the U.S., Japan and Europe. Nuclear stakeholders can secure LTO through periodic safety reviews, probabilistic risk assessments and surveillance techniques.

Around 67% of the world’s nuclear reactors are over 30 years old.

Source: International Atomic Energy Agency

Building new nuclear projects remains a formidable challenge. High capital costs, complex and shifting regulations, supply chain disruptions and skilled labor shortages complicate delivery, while securing licensing can slow project inception.5

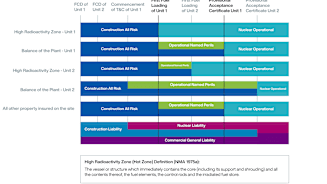

Aligning risk allocation, indemnities and insurance can lay the groundwork for successful construction — important as most value is lost (or won) before fuel loading.

Infographic

Infographic

Case Study

Case Study

Technology only scales with people — but in nuclear, a retirement bulge and recruitment bottlenecks threaten growth. “The energy sector as a whole has been suffering from the effects of the 'great crew change.' A lot of key technical talent is retiring and there isn’t a sufficient level of replacement in the adjacent generations,” explains Joanna Stacke, Aon's Energy & Natural Resources Sector Head, Talent Solutions, North America.

of French nuclear workers may be retirement-eligible by 2030, though 100,000 new hires will be needed in the next decade.

Source: Damona

of the American nuclear workforce is expected to become eligible for retirement within the next decade.

Source: U.S. Department of Energy

of the UK civil and defence nuclear workforce is aged 30-49 and 36% is over 50.

Source: ECITB

of Canada’s nuclear workforce is aged 50 and above, signaling a looming retirement wave.

Source: Canadian Nuclear Association

The “silver tsunami” looms over the sector, which has a proportion of workers approaching retirement than both the wider energy workforce and national averages. Attracting new talent is increasingly competitive, with nuclear energy vying against technology and finance for top recruits. Yet Big Tech’s investment in nuclear to power artificial intelligence (AI) platforms is also helping to reshape the sector’s public image, making it more appealing to younger professionals.

Talent cultivation initiatives, like Destination Nuclear in the United Kingdom and the Nuclear Reactor Safety Training and Workforce Development Program in the U.S., aim to build the next generation of nuclear professionals — with safety top-of-mind. Mentorship, knowledge transfer and frameworks from the International Atomic Energy Agency and World Association of Nuclear Operators remain vital, alongside strategies to keep organizations’ talent engines running — and growing.

Case Study

Expert guidance is key to cutting through the regulatory, risk and insurance maze in nuclear. Aon’s global industry experience helps clients take their projects from concept through construction to full operation efficiently.

Let’s connect to explore your goals and share what we’re learning from complex nuclear programs across markets — so you can scale safely, predictably and with confidence.

01

Enable informed decision making on the siting, design and construction of nuclear developments.

02

Gain access to broad, cost-effective coverage — no matter where you are in the nuclear fuel cycle.

03

Align workforce planning, learning and development, and safety culture with asset strategies.

Sam Beaver

Power Leader, Global Broking Center

Brian DeBruin

Managing Director, Natural Resources/Power & Renewables, United States

Barbara Gutierrez

Senior Vice President, Natural Resources/Power & Renewables, United States

Brian Hearst

Managing Director, Data Center & Life Sciences Builders Risk Leader, North America

Charles Philpott

Global Natural Resources Leader, Enterprise Client Group

Mark Potter

Natural Resources Leader, United Kingdom

Nora Sherman

Director, Executive Compensation Solutions, United Kingdom

Joanna Stacke

Energy & Natural Resources Sector Head, Talent Solutions, North America

Simon Thompson

Human Capital Industry Leader, Natural Resources, Europe, the Middle East and Africa

Paul Young

Commercial Risk Industry Specialties Leader, Europe, the Middle East and Africa

1 Plans For New Reactors Worldwide, World Nuclear Association

2 Nuclear Energy, Our World in Data

3 The fastest energy change in history continues, PV Magazine

4 IAEA Releases Nuclear Power Data and Operating Experience for 2023, IAEA

5 Community groups warn against push to ‘rip up’ UK nuclear industry rules, The Guardian

General Disclaimer

This document is not intended to address any specific situation or to provide legal, regulatory, financial, or other advice. While care has been taken in the production of this document, Aon does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the document or any part of it and can accept no liability for any loss incurred in any way by any person who may rely on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication and is subject to any qualifications made in the document.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

Better Decisions Across Interconnected Risk and People Issues.

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Explore Aon's latest environmental social and governance (ESG) insights.

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

Better Decisions Across Interconnected Risk and People Issues.

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

These industry-specific articles explore the top risks, their underlying drivers and the actions leaders are taking to build resilience.

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Read our collection of human capital articles that explore in depth hot topics for HR and risk professionals, including using data and analytics to measure total rewards programs, how HR and finance can better partner and the impact AI will have on the workforce.

Explore our hand-picked insights for human resources professionals.

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

The challenges in adopting renewable energy are changing with technological advancements, increasing market competition and numerous financial support mechanisms. Learn how your organization can benefit from our renewables solutions.

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

Better Decisions Across Interconnected Risk and People Issues.

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

Article 6 mins

Addressing the retirement pay gap issue between men and women starts with first acknowledging it exists. Then companies can conduct further analysis and adjust their benefit plans accordingly.

Article 8 mins

AI acceleration, rising healthcare costs and changes to workforce skills are transforming organizations. Our analysis of financial services, life sciences and technology companies provides insights on how to redesign roles, reskill at scale and reimagine talent strategies to stay competitive.

Article 10 mins

Workforce-related risks — spanning health, benefits, safety systems, and data and analytics — are not just operational concerns but strategic drivers. When activated, they positively shape the total cost of risk and long-term resilience for industrials and manufacturing organizations.