Construction and Infrastructure Insurance and Risk Management

Help Mitigate Construction Risk

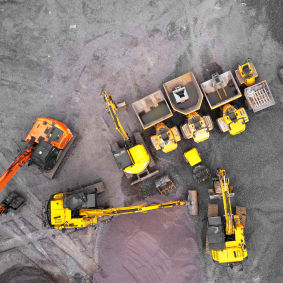

The risks impacting the construction industry are constantly evolving. Contractors, owners, developers, engineers, architects, designers, financiers and investors face an expanding construction and infrastructure risk environment. Businesses must contend with inflation, higher financing costs, geopolitical concerns, supply chain disruptions, extreme weather, workforce shortages, cyber incidents and a changing regulatory landscape.

Aon is a global leader in providing insurance and risk management solutions within the construction and infrastructure industry. We design and place innovative risk mitigation, risk capital and alternative finance solutions to protect organizations of all sizes and complexity, empowering them to make better decisions. Our team of seasoned advisors understands the complex nature of construction projects and the significance of managing risks at an enterprise and holistic level. Using proprietary data and analytics, insights and tools to deliver the full extent of the risk capital value chain, Aon's subject matter specialists assist clients with their risk capital and human capital needs.

Industry-Specific Offerings for Construction and Infrastructure

-

Property Insurance

Protect against accidental damage to property and/or materials on your project during construction and operations. Aon works with you to develop a strategy to minimize the impact of a potential loss event.

-

Casualty Insurance

Protect your business against third-party claims or negligent acts or omissions resulting in bodily injury or property damage on your premises during your project during construction and operations.

-

Construction Professional Liability Insurance

Protect insureds - including designers, architects, engineers, contractors and developers - from damages that may be caused by professional errors, omissions or negligence.

-

Project Risk Advisory Services

Form a clear understanding of project-specific risks to develop appropriate and effective risk transfer, management and/or mitigation strategies.

-

Subcontractor Default Insurance

Get coverage for economic losses incurred by a general contractor or construction manager caused by a default of performance of their subcontractor(s).

-

Surety Bonds for Construction

Gain financial security by using surety bonds to guarantee that contractors will perform the work and pay specified subcontractors, laborers and material suppliers.

Video 1 Min Watch

Navigating Construction Industry Risks

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Discover how your organization can benefit from Aon's specialists in construction and infrastructure to navigate this volatile landscape.

Discover Aon’s Data Center Lifecycle Insurance Program

Aon has collaborated with leading insurers to launch an insurance solution aimed at covering your global data centers which is backed by substantial market capacity – to provide a suite of both construction and operational covers under a single policy.

-

Expanding Risk Environment

Data centers are complex ecosystems that are becoming increasingly important to society’s ever-demanding digital future. Constructing a data center involves careful planning and coordination, including consideration of energy usage and capacity of various operational systems. Each component, from the power supply and cooling systems to network architecture must be meticulously designed, constructed and maintained to prevent downtime and optimize performance.

-

An innovative lifecycle solution for Construction Clients

As trusted risk advisors, our team partners with organizations at every stage of their risk journey, helping to mitigate financial impact from losses and optimize outcomes through ongoing and collaborative conversations. Leveraging our global partnerships and key markets, we have access to specialist construction, liability, operational and cyber insurer capacity and expertise, extensive experience in data center and digital infrastructure and coverage items for the data center industry.

-

What are the benefits

- One fully integrated wording with an established set of leading underwriters.

- Seamless coverage from construction through to operational phase.

- A single solution that provides coverage for a range of risks that would otherwise require separate wordings and policies.

- Comprehensive multi-line insurance that covers Property, Liability, Construction, Delay in Start-Up, Business Interruption, Cyber, Cyber Property Damage, and Tech E&O. Additional options include cover for Marine Cargo, Terrorism and US Excess Liability.

- Pre-agreed capacity from a panel of insurers.

- Security: Supported by A rated or higher security through a combination of Lloyds and Company markets.

- Risk engineering support and capabilities can be provided alongside the overall insurance package.

- Bespoke Coverage: Specifically designed for data centers, tailored to address their unique risks and operational needs.

-

Who this is for

- Data Center Developers

- Private Equity companies that fund data center developments

- Contractors’ controlling data center construction cover

Product / Service

Data Center Lifecycle Insurance Program

Why Work with Aon

Aon partners with organizations at every stage of their risk journey to help mitigate the financial impact of losses and optimize client outcomes using a collaborative approach. We advise on globally available risk capital transfer strategies. We are constantly looking to design and develop new products and solutions to help our clients manage, mitigate and/or transfer their most pressing risks. Our connected global team can help clients worldwide make decisions with clarity and confidence in a complex risk environment.

-

Wide Range of Insurance Coverage Areas

We use broking experience and Aon’s global network to provide construction and infrastructure clients with industry-leading terms and conditions across a wide range of insurance coverage areas, including:

- Automotive Insurance

- Construction Property Insurance

- Builders Risk Insurance

- Construction All Risks Insurance

- Erection All Risks Insurance

- Contractors Equipment Insurance

- Installation Floater - Operational Property Insurance

- Cyber Liability Insurance

- Employment Practices Liability Insurance

- Pollution Liability Insurance

- Construction Liability Insurance

- General Liability Insurance

- Umbrella Insurance

- Excess Liability Insurance - Operational Liability Insurance

- Contractor Controlled Insurance Program

- Owner Controlled Insurance Program

- Construction Professional Liability Insurance

- Professional Liability

- Professional Indemnity

- Owners Protective Professional Indemnity

- Contractors Protective Professional Indemnity - Surety Bonds

- Subcontractor Default Insurance

- Worker’s Compensation Insurance

-

Global Reach

Aon’s global reach, experience, and resources help you to protect your project and people and grow your bottom line. Our global team of over 900 construction industry specialists offers a comprehensive, collaborative, and tailored approach. We use our relationships with global sources of risk capital to ensure we are marketing your risk to the broadest number of market participants.

-

Industry-Leading Broker

With Aon, you can be confident about securing insurance with industry-leading terms and conditions, pricing and claims resolution. Around the globe, our experienced brokerage team leverages strong market relationships to deliver institutional knowledge of local legislation and regulations impacting contractors. Your program is customized — and optimized — for your company’s objectives, particular risks and the geographies in which you operate.

-

Client Impact and Value

We help contractors discover innovative and efficient ways to manage risks ranging from job site injuries to equipment loss to construction defects — so they can keep projects on time and on budget.

We help owners and developers mitigate exposures to cost overruns, delays, environmental liabilities and other hazards that can derail construction projects and operations.

The information contained on this page and the rest of this website is subject to the terms and conditions found here.

$4B+

Globally, Aon has placed $4 billion in premiums for the construction and infrastructure industry.

More Construction Industry Insights

Read the latest articles, reports and podcasts about the construction and infrastructure industry from our team of thought leaders.