BESS presents a sizable and growing opportunity for insurers, including traditional property and casualty (P&C)

cover, warranty and performance cover, cyber for smart systems, parametric outage triggers, energy-as-a-service

embedded insurance, residual value guarantee products and battery health-linked premiums.

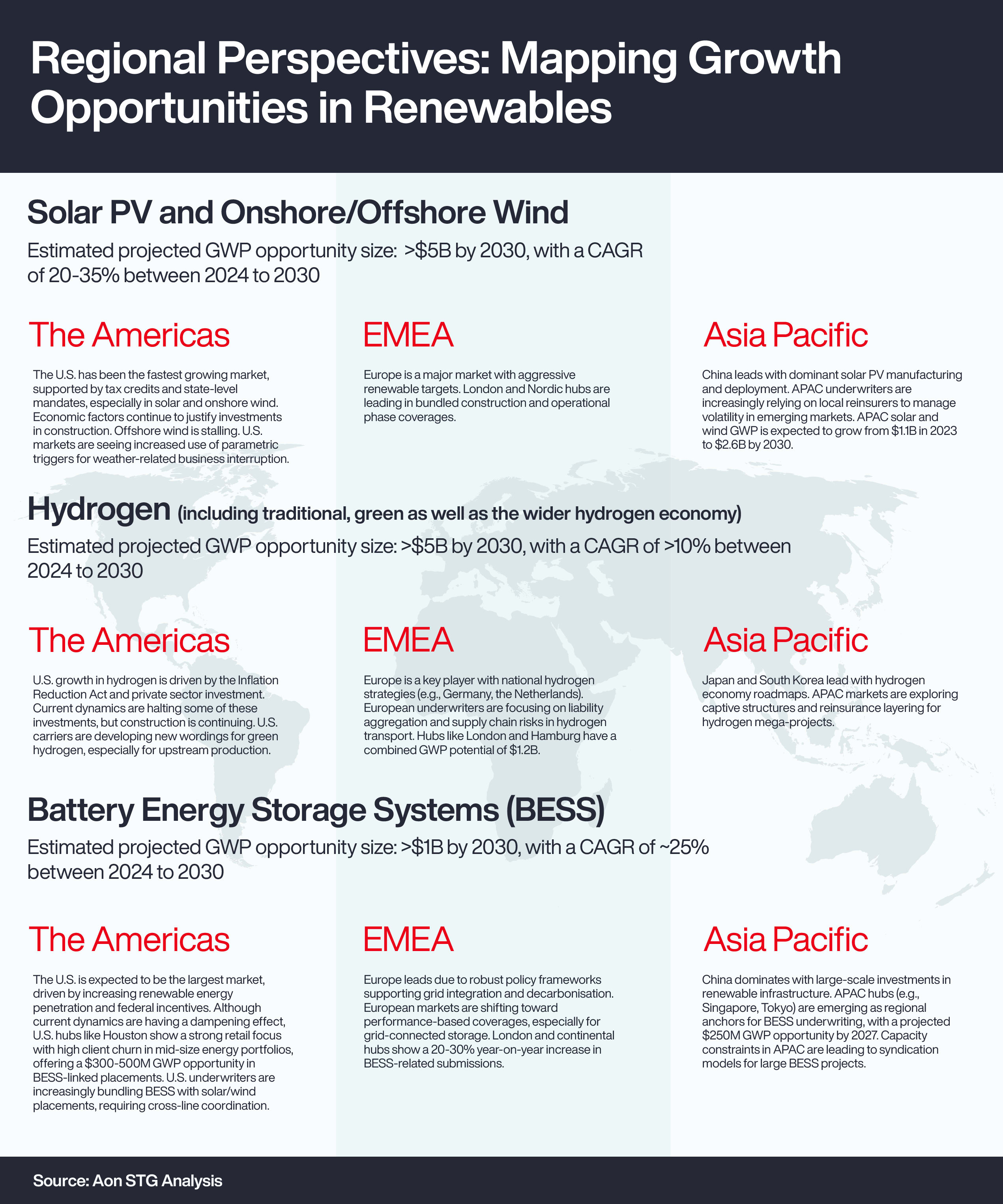

The projected gross written premium (GWP) opportunity size by 2027 is estimated to be more than $1 billion, with a

high CAGR of ~25 percent between 2024 to 2030.4* This growth is driven by various segments, including:

- Utility batteries, which help integrate variable renewable energy into the grid by smoothing out supply

- Manufacturing batteries for both electric vehicles (EV) and storage applications, repurposing "second life" EV

batteries for storage and using EV batteries to supplement grid flexibility through smart charging

- Behind-the-meter batteries, which cater to commercial, industrial and residential customers, typically installed

with rooftop solar photovoltaic (PV)

The Asia Pacific (APAC) region currently constitutes approximately half of the total market for BESS, with China

holding the lion’s share. South Korea, too, is a sizable market and often looks to Singapore markets for capacity on

large and complex accounts. London plays a crucial role in arranging insurance for the key countries driving the

adoption of BESS in Europe, including the UK, Germany and Spain, as well as for the U.S., which holds a significant

market share. Chile is the primary early adopter of BESS in South and Central America; however, the premium

opportunity is limited.

Some risks associated with BESS, such as thermal runaways leading to fires or explosions and performance degradation

due to environmental exposure and charging cycles, will require innovative insurance products that can help to serve

the needs of this evolving market.